It’s Superbowl season again. Who will win this year? One can’t say for sure, but chances are it won’t be the team that misses blocks, fumbles punts, throws interceptions, and is offsides too many times. As every good coach – and general and CEO – knows, the value of a great strategy depends on the quality of a team’s execution. Some might even say that great execution is a viable strategy all on its own.

This fundamental precept is no less true for our financial lives than it is for high-stakes sports and business situations. Yet great execution of the basics of personal financial administration doesn’t typically get much respect. Perhaps that’s because there’s so little of it around. But I also suspect that it’s because talking about strategic-this and strategic-that makes both providers and consumers of financial advice feel smart and important. Don’t get me wrong: I agree that strategy can play an important role in financial success. But I can also tell you that a great financial plan won’t do you much good if you fail to execute on the basics. And while some individuals honestly believe that they have the persistence and focus and knowledge and diligence to ace the execution of their plan without outside support, I haven’t personally seen many examples of that. In the real world, if it isn’t somebody’s job to help ensure that the basics are addressed, chances are really good that they won’t be. Our lives are simply too busy and too complex to afford us the luxury of focusing on things that aren’t our first-tier priorities, like our careers, our families, and our personal health and well-being. In my experience, financial grunt work is way down on most people’s priority list.

It is precisely for this reason that we at Griffin Black focus not only on formulating an appropriate financial strategy for our clients, but also on working with them on an ongoing basis to help make sure that the job gets done. That is not possible if we write a plan, hand it over to a client, and walk away. And contrary to what many consumers may think, the execution of a client’s investment strategy is only one part of excellent personal financial administration. Here are some other examples of the elements of the great personal financial blocking & tackling that we aim to help all of our clients execute.

Know Who’s Playing On Your Team – And What Their Role Is

What football team would fail to take into account who was on their active roster in preparing for a big game? Not a winning one, for sure.

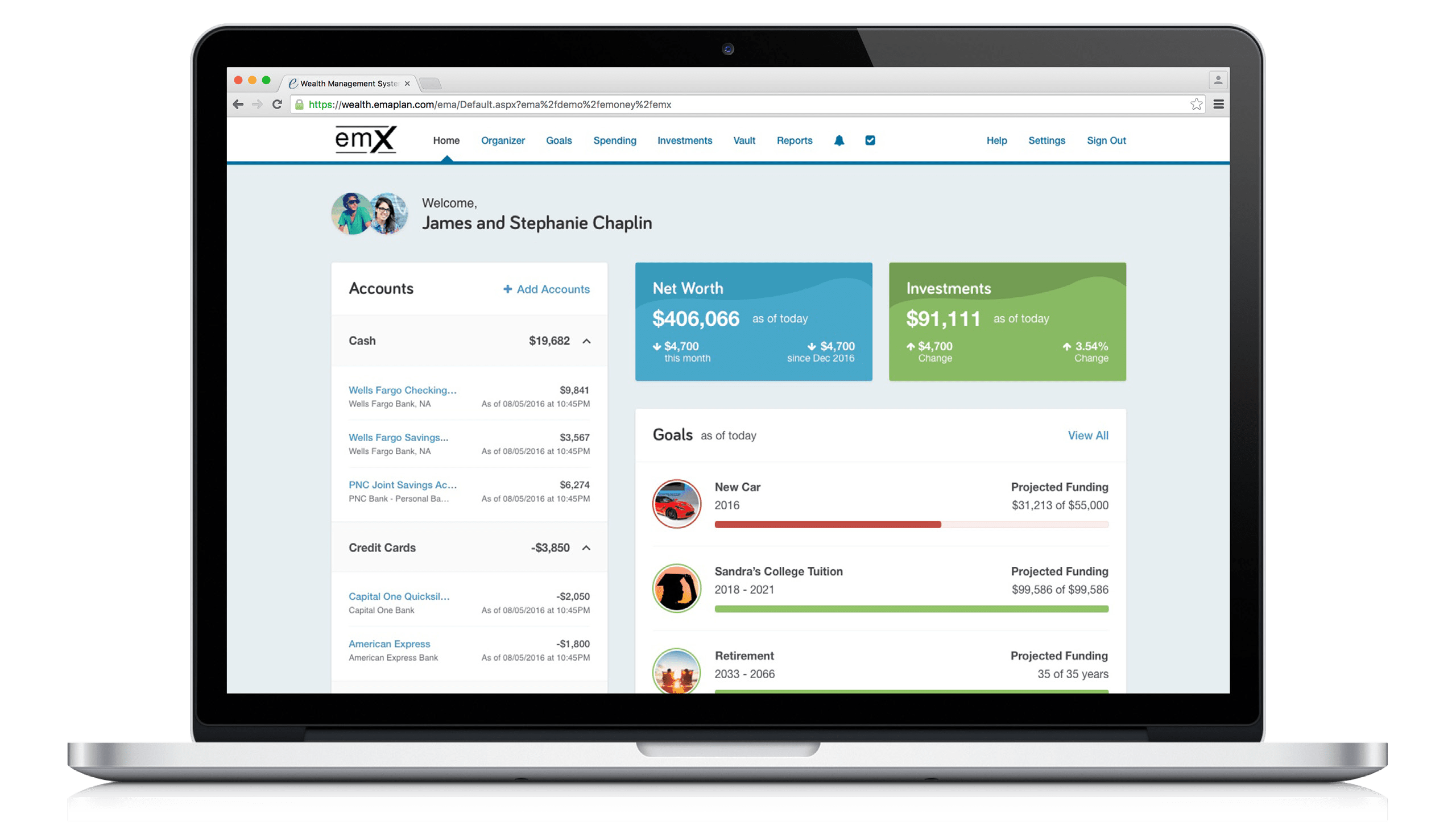

Would it surprise you to learn that most individuals don’t know what they earn (after tax), don’t know what they spend, and have only the vaguest idea about how much they own net of their debts? That’s because getting a complete view of one’s overall financial life can be difficult. But as the old saying goes, if you can’t measure it you can’t manage it, and so getting an accurate reading of all of what is going on with your money is a critical first step to financial success.

To be sure, there are tools on the market that can help the do-it-yourselfer, but really building and maintaining a workable picture of your personal financial enterprise is something that most of us need ongoing help and support with.

And how about those old 401(k) accounts that you left with previous employers and then lost track of? You haven’t looked at them in years and can’t remember what you invested the money in, much less whether those choices are appropriate given your current situation and goals. And then there’s the insurance policy that you started funding but haven’t thought about in years. Can you remember why you purchased it? Is it still worth the money you’re paying for it? Or would you be better off re-directing those hard-earned dollars to your retirement fund instead? Got an extra checking account that you used to use but don’t anymore because you moved? Getting rid of old and non-functional parts of your financial “machinery” can be as important as creating structure that you need, because unnecessary complexity is costly. Shedding unwanted accounts and products frees you up to devote your attention to the parts of your infrastructure that matter to you and to your strategic plan.

Drill Until The Plays Are Automatic

A winning football team doesn’t just know how to make great plays: it drills, and drills until players do them without thinking.

Everybody knows that the key to getting, and staying, financially healthy is spending less than you earn – in other words, saving. In fact, nothing else that you do will ultimately matter if you spend away all of your career earnings and investment gains. And unlike investment returns, we have tremendous control over what we save.

Why then is saving so difficult? For most workers, and particularly for middle- and upper-income families, most reasons fall into two categories: emotional and structural. And while emotional barriers to saving are important, the structural barriers generally don’t get enough attention. The fact is that we tend to make it difficult for ourselves to save, when it should be easy. To counteract this tendency, good financial administration will reduce as many barriers to saving as possible. It will, in other words, create a saving machine, as follows:

- Identifying how savings fits into your overall financial capabilities (see “visible & manageable” above).

- Creating the right savings vehicles. Do you need IRAs or Roth IRAs or both? If you’re a business owner, do you have the right kind of retirement plan? How about a traditional investment account versus “cash”-type savings? You need the right structure for your plan – no more and no less.

- Making it automatic. Decisions that you have to make every month or year are difficult. Auto-pilot is easy, and relatively painless.

- Starting early. Ah, the road to hell is paved with good intentions. How many people wake up one day looking at retirement and say to themselves, “Why in the world didn’t I start when I was 30?”. Why indeed – but most of us need a push to get started.

- Staying the course. Follow up to make sure you’re meeting your targets. The most amazing thing happens when we begin to pay attention to something: it magically responds to what we want.

None of this is rocket science, you may say. Precisely, I will respond. The problem isn’t that we don’t know that we’re supposed to be doing this; the problem is that we don’t get out there on the practice field and do it until it becomes automatic.

Hone Your General Athletic Skills For Solid Performance

Whatever your sport, you need to be in good overall physical condition to play it well. In personal finance, getting and staying in good shape includes making sure that your household isn’t “leaking” money. Financial “leaks” occur when money leaves you unnecessarily or without providing adequate value in return. Merely not spending money is not the goal here. The goal is to spend your money as wisely and as productively as possible, and there are a number of ways in which we help clients to do that.

For example, the costs associated with an investment do matter, yet cost-efficient investing isn’t just a matter if buying the cheapest option on the market. There are times when the cheapest option is the best option. In other cases the additional expense is, in our opinion, justified by the nature of the investment. Ask yourself this: Do you buy everything you own at Walmart? Our goal is always to be thoughtful about the cost/value relationship of investments we recommend to clients.

There are other cases where we can clearly benefit clients simply by purchasing a less expensive version of the same product they would have access to on their own. The “retail” products that individuals can purchase directly through their broker typically charge much higher internal fees than the “institutional” versions of those very same funds that we can purchase for client accounts. That’s “free money” for our clients. In addition, we never charge a “load” (sales fee), even on funds that carry loads. And we take advantage of special “advisor” pricing for 529 investments and pass the cost savings along to clients.

We also help clients avoid unnecessary costs elsewhere. When shopping for insurance and annuities, we will help clients compare the prices of commissioned products with those of “low-load” (fee only) products. We will also work with clients to analyze older annuities they may have and, where appropriate, roll funds from products with very high internal costs into better products with low internal costs.

Is that income property you have performing as you wished? Or is it a drain on your monthly cash flow that could be replaced with something better? We’ll put this on the table and help a client determine which option is the best one for them. We can also help you determine where there may be other unnecessary drains on your available cash flow.

Tax efficiency is also an important goal if you want to keep as much of your heard-earned money as possible. Are you taking advantage of all the tax-deductible savings opportunities that you have? On the other hand, are you thinking about how you might minimize your lifetime taxes and not simply about paying the lowest possible tax in any one year? There are times when it may, in fact, be smarter to pay a little tax now if it affords you the possibility of avoiding a lot of tax later on. Are you also investing for good tax efficiency? Are you adjusting your practices for the changing tax laws from year to year? Like any changing field of play, tax-efficient financial management is an ongoing process and not a one-time event.

Play An Error-Free Game

Have you ever been frustrated when your favorite team fumbles the ball, throws an interception, or is penalized on a key play? Of course. That’s sloppy play, and it usually loses you the game.

Your financial affairs demand the same attention to avoiding errors if you expect to make the most of your resources. Yet being aware of all the pitfalls and avoiding them is something that is difficult to do without ongoing guidance. For example:

- Have you filled out the Beneficiary Designations for your IRAs correctly? If your family situation changes, did you change them?

- Are you aware of when you need to sign up for Medicare/Social Security – regardless of what your Social Security withdrawal strategy is?

- Have you updated your estate plan in the last five years?

- Did you start making catch-up contributions to your 401(k) when you turned 50?

- Are you taking your IRA Required Minimum Distributions on time?

Are you aware that you need to think about managing your income beginning several years before you’re going to fill out the FAFSA form for your college-bound student?

Take Advantage Of Your Special Teams

They spend most of their time off the field of play, but special teams can win games. Similarly, an ability to take advantage of unique financial circumstances and little-known opportunities can make a tremendous difference in your overall financial success.

Most people never know about unusual possibilities or opportunities because they can appear suddenly or in unique circumstances. Helping clients take advantage of such opportunities is something that we’re very excited about being able to do because they can represent a real financial windfall. Unfortunately, we can’t always predict when, and who, we’ll be able to help in this regard, but we do know that when we can, it’s always as a result of our ongoing relationship with and thorough knowledge of a client’s circumstances. For example:

- Did you begin making regular Roth IRA conversions in 2010, when the law first allowed high-income individuals to do so?

- Did you know that you can choose to use your fully-tax-deductible HSA account as a long-term savings vehicle if you wish? We can invest it for you just as we would an IRA.

- Have you considered that there are interesting opportunities that present themselves if you lose a lot of money one year, either from a business loss or the sale of a property that has accumulated passive losses?

- Do you know what to do with early-stage options?

- Do you know where to look for scholarship funds – not just loans – for your college-bound student?

- Have you thought about creating separate IRA accounts in order to give your children (and grandchildren) different options in your overall estate plan?

These are a few of the many possibilities that may present themselves. We’re always on the lookout for others. One can’t always plan for them per se, but one can recognize them and take advantage of the opportunities that we find.

The Basics Will Take You A Long Way

Good blocking and tackling will help make any financial strategy you choose successful. Just remember:

- Know what you earn, spend, owe, and own.

- Make your savings easy and automatic.

- Plug financial leaks wherever you can.

- Avoid financial errors.

- Take full advantage of unusual and occasional financial opportunities.

Good luck with your game!