Let life with wealth

be a both | and adventure...

Let life with wealth be a both / and adventure...

What if the old way of managing money can’t get you where you want to go?

Let’s face it, you’re a successful professional. But your financial life feels less than perfect. There’s something missing, and you’d like to fix it.

On the one hand, you’re bombarded with folks trying to sell you on the latest trends:

Free loans! Crypto! Real estate! Tech stocks! Options! You definitely don’t want to miss out, but you also don’t want to do something you’ll regret. How to you make sense of it all?

On the other hand, there are little voices in your head whispering a different kind of messages:

“If you don’t have a million bucks (or 3 or 5), you just don’t measure up…”

“Just do what you love and don’t worry about money…”

“Debt is bad! Stocks are risky!”

You feel pulled, first in one direction and then in another. Trying to deal with it all is confusing, and exhausting. Your life and career don’t leave time for this. There’s got to be a better way.

Money is an emotional as well as an intellectual beast.

Some days you’re drawn to the intellectual aspects of money. These are the technical and analytical facets of finance and investing. All the external influences that crowd our financial lives, including the cacophony of messages from the media, the internet, and the financial industry itself.

On other days you deal with your finances instinctively, based on internal influences of how you think and feel about money. Yet a decision that feels right in the moment, but hasn’t been subjected to factual or analytical rigor, can cause you to stumble, or at least fall short of your potential.

Doing money well means bringing all of yourself to the task: a both/and synthesis of your intellect with your instinct.

At Griffin Black, we help you do just that.

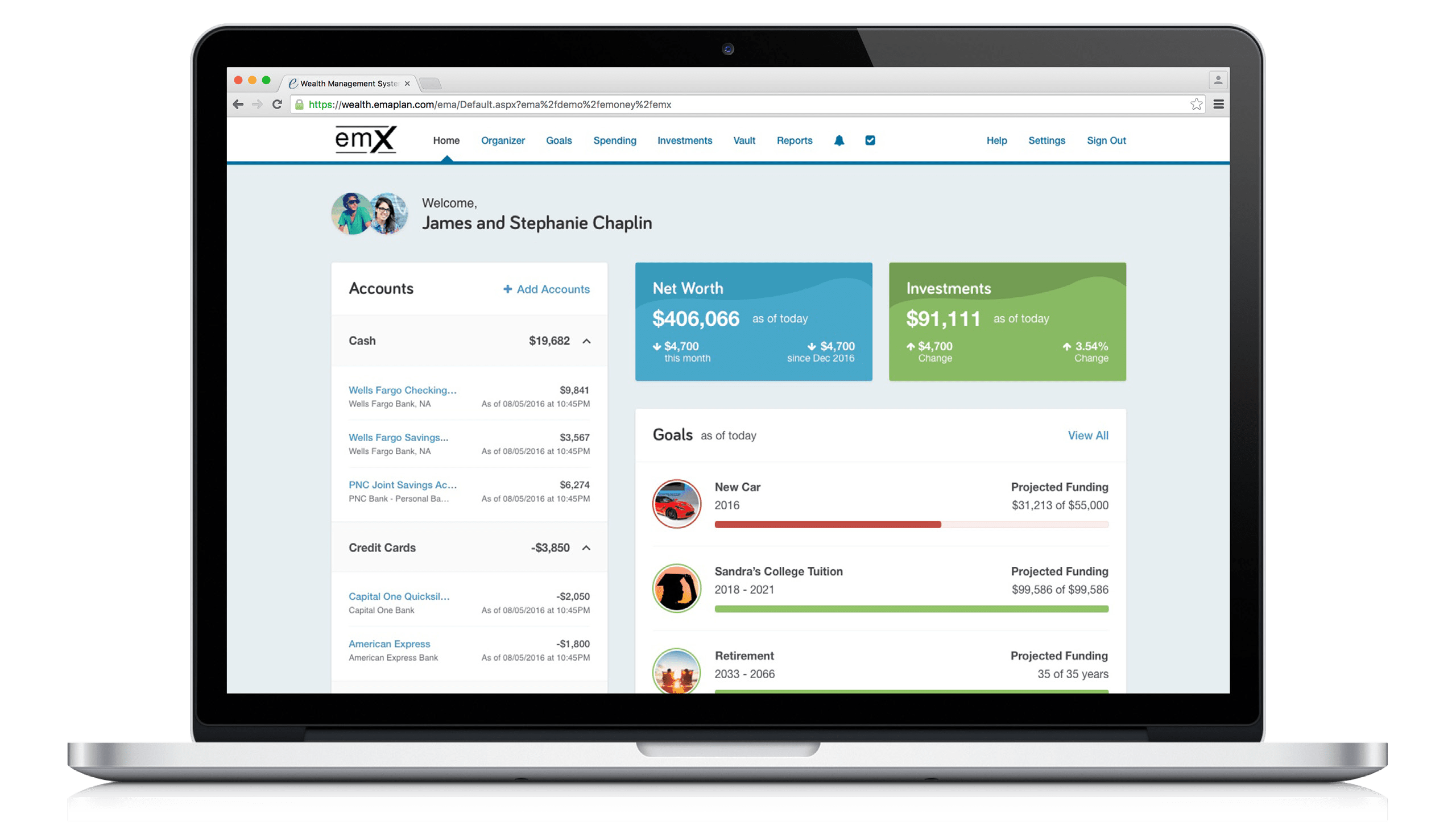

We’re seasoned experts in technical financial matters: investing, tax planning, cash flow, insurance, alternatives, debt management – you name it. We also understand the many ways in which financial outcomes are driven by intrinsic factors, sometimes unconsciously so. We use a proven approach to invite you to integrate your intellect with your instinct in order to make better financial decisions.

Then, when you’re ready, we help you apply sophisticated financial tools and strategies that make the most sense for you. The result? Your stress and confusion give way to intellectual confidence. Your both/and focus minimizes “WealthLeak.” Your decision making is easier and more effective. And your quantifiable results are stronger than any follow-the-fad strategy could reliably achieve.